We will start this story with Steel Industry and China’s place in the equation. China has been at the front line of steel manufacturing for a long while now, delivering over half of the world’s steel. Also, since the vast majority of their production lines are owned by the Chinese State, they have access to cheap credit (debt). This worked in China’s favour much to the detriment of other steel makers across the world. At the point when the world was being inundated with cheap steel from China, there was another intriguing dynamic being played out somewhere else in this Industry.

Manufacturing Steel:

Steel is produced from iron ore or scrap. Iron ore is a mineral aggregate that can be converted into iron. The quality of the iron ore is mainly determined by its composition; a high iron content and low sulphur and phosphorus contents are favourable. Iron ore can be found all over the world, but it’s iron content varies.

Steel scrap is selectively collected for several decades and is recycled as valuable raw material for steel production.

There are two ways to produce steel: Blast Furnace and Electric arc furnace (EAF).

Making Steel through Blast Furnace:

You take iron ore. It’s largely iron oxides. You have to remove the “oxides” part. So you heat the waste out of it to remove the oxygen. This is done in a blast furnace, with iron ore, coke, and limestone. And then, molten iron is produced.

Now, Iron to Steel with a Basic Oxygen Furnace (BOF):

If you put molten iron or scrap into a big furnace and direct a strong stream of oxygen towards it, the oxygen removes the carbon, silicon, sulphur and phosphorus that is in molten iron – and it becomes steel.

This is how around 74% of the world’s steel is produced, in a Basic Oxygen Furnace.

But what does this have to do with Graphite electrodes?

There’s another way to make Steel.

The Electric Arc Furnace (EAF) method:

Take scrap steel. You know cars, and old bars and all that. Put them in a massive container. Lower a lid which has electrodes in it. When a high current is passed through the electrodes, the heat generated which will melt the scrap steel.

The temperature required to melt scrap steel is 3000-Celsius and Graphite electrode is the only commercially available material which can withstand such intense heat while still conducting electricity.

Hence, the graphite electrode is an indispensable component in the manufacturing of steel through EAF.

After that following stages are performed: production of liquid steel, hot rolling, and cold rolling, applying a metallic and/or organic coating.

Now Blast furnace thing is a highly polluting thing. You burn coke, and it exudes smoke and gases and all sorts of things that ruin the atmosphere. EAF is much less toxic for the environment. You use electricity instead of burning through coke for the steel making process, and you reprocess used scrap steel. Less Pollution, Right?

Source: Arcelormittal website

Total Steel Production (in Million Tonnes):

| Year | Total Steel Production | EAF | % EAF of Total Steel |

| 2013 | 1,606.00 | 453.00 | 28.21% |

| 2014 | 1,663.00 | 426.00 | 25.62% |

| 2015 | 1,617.00 | 406.00 | 25.11% |

| 2016 | 1,627.00 | 412.00 | 25.32% |

| 2017 | 1,689.00 | 473.00 | 28.00% |

Source: Investor Presentation, Graphite India Limited

Source: Investor Presentation, Graphite India Limited

Now, let us throw some light on Electrode industry.

Graphite Electrode Manufacturers are of a peculiar kind. There have been no new contestants in this space for as far back as 40 years and the existing players were struggling to stay profitable. These electrodes are very difficult to make and for a very long time hasn’t been a worthwhile undertaking to invest in.

Between 2015 and 2017 EAF steel manufacturing facilities found it extremely difficult to compete against the cheap steel coming out of blast furnaces in China and when steel production through EAF was cut down, graphite electrodes fell out of favour. Prices hit rock bottom and many facilities across the world became unsustainable.

Basically, there are two types of electrodes:

Ultra High Purity (UHP) Electrodes:

UHP Electrodes are the highest quality of electrode available in the world. These are majorly produced in India, Japan, and Europe. Few Chinese firms have the technology to produce UHP Electrodes. These are used in Electric arc furnace to melt scrap steel. Major Raw material to produce this type of electrode is Petroleum Needle Coke (we will study about raw material in later part of this blog).

Non-UHP Electrodes:

Non-UHP Electrodes are of a lower quality. These are majorly produced in China. These are used in Ladle furnace (Used in producing steel billets) to melt scrap steel. Major Raw material to produce this type of electrode is Pitch Needle Coke.

| Particulars | UHP | Non-UHP |

| Usage | Electric Arc Furnace | Ladle Furnace |

| Raw Material | Petroleum Needle Coke | Pitch Needle Coke |

| Drawbacks | Expensive, Scarce supply | Lower output of steel per ton, Pollution |

Raw Material Supply Chain of Electrodes:

When you refine crude oil, coke is the by-product and when you refined this coke, Petroleum needle coke is produced, which is the purest form of coke. Needle coke gets its name from its needle-like shape.

This Petroleum Needle coke is used in UHP Graphite Electrode and is an indispensable raw material in the production of Lithium-ion batteries which are used in Electric Vehicles.

Similarly, from tar pitch, Pitch needle coke is produced, which is used to make anodes for the aluminium and also used to produce Non-UHP Graphite Electrode.

Out of total Pitch needle coke produced, 95% is used in making anodes and just 5% is used to make Non-UHP Graphite Electrodes.

Now, this Petroleum needle coke is produced by just 4 players in the world where GrafTech, a Graphite Electrode producing company has an in-house plant of Needle coke, so effectively there are only three players. The Greenfield expansion of needle coke industry is extremely difficult and it will take a long time to materialise even a few thousand tonnes of expansion.

In India Pitch needle coke is produced by Indian Oil Corporation, hence demand supply is roughly balanced.

Source: Centrum Broking Research Report

Source: Centrum Broking Research Report

You can see in the above diagram that the use of needle coke in Batteries is expected to increase substantially. The needle coke industry is highly concentrated and petroleum needle coke demand is increasing due to its use in Lithium-ion batteries used in electric vehicles. Hence, the timely availability of adequate needle coke at a reasonable price shall determine the effective/profitable utilisation of any meaningful addition to electrode capacity across the industry.

As we all know, EVs are going to be the next big thing in the Automobile industry and EAF is going to be a gamechanger in the Steel industry. So, time will tell how this iconic tussle will fare out for needle coke demand.

Why China Prefers Blast Furnace over EAF?

The cost of Raw material of Blast Furnace was considerably lower than the Cost of Raw material of EAF. The delta between the cost of raw materials was around $60-70 per tonne in the Year 2015-16, making it cheaper for Chinese steel companies to produce through Blast Furnace.

Moreover, there has been no new entrant in this industry since 1977.

However, in the past year or two, the delta between the cost of raw materials has reduced to $18-20, making it beneficial for EAF manufacturing and consequently for Graphite Electrode Industry.

BF Production cost in 2018:

| Particulars | Cost/Unit US$ per tonne | Required per tonne | Cost US$ |

| Iron Ore | 65 | 2 | 111 |

| Coking Coal | 200 | 1 | 180 |

| Power (Kwh) | 0 | 550 | 34 |

| Scrap | 340 | 0 | 34 |

| Ferro alloys | 1,200 | 0 | 18 |

| Other raw material | 35 | 1 | 35 |

| Labour | 30 | 1 | 30 |

| Transport and others | – | – | 25 |

| Total Cost | 467 |

EAF Production cost in 2018:

| Particulars | Cost/Unit US$ per tonne | Required per tonne | Cost US$ |

| Scrap | 340 | 1 | 374 |

| Power (Kwh) | 0 | 500 | 31 |

| Ferro alloys | 1,200 | 0 | 12 |

| Graphite Electrodes | 12,000 | 2 kg | 20 |

| Labour | 20 | 1 | 20 |

| Transport and others | – | – | 25 |

| Total cost / Tonne | 482 |

As you can see graphite electrodes cost is $ 20 (when the price is assumed 12000$) which is just 4% of total cost (even though it is the main component to produce steel through EAF), so even if prices of electrodes increases it will not affect the steel manufacturers much.

Now, the graphite electrode was loss-making avenue for the last few years, for following reasons:

a) Needle coke price increased during period of 2015 to 2017

b) Graphite electrode price decreased during period of 2015 to 2017

As a result, the margin decreased substantially while debt was rising because the majority of the company did capex in 2012-13. As a result, the Graphite electrode industry was struggling and therefore there was consolidation in the Graphite Electrode industry. Due to overcapacity in the Electrode industry, six plants mainly in Europe and America had to be closed down over the last three to four years bringing down the Electrode capacity by around 200,000 MT.

The third Largest player in 2014, Shawn Denko acquired second Largest Manufacturer SGL, as SGL was struggling in down-cycle during that time.

In the below table, you can see the shutdown of capacities and acquisition.

| Serial Number | Company Name | 2010 In ‘000 Tonnes | 2014 In ‘000 Tonnes | 2017 In ‘000 Tonnes |

| 1 | SDK | 105 | 105 | 225 |

| 2 | SGL | 230 | 180 | – |

| 3 | Graf Tech | 245 | 185 | 167 |

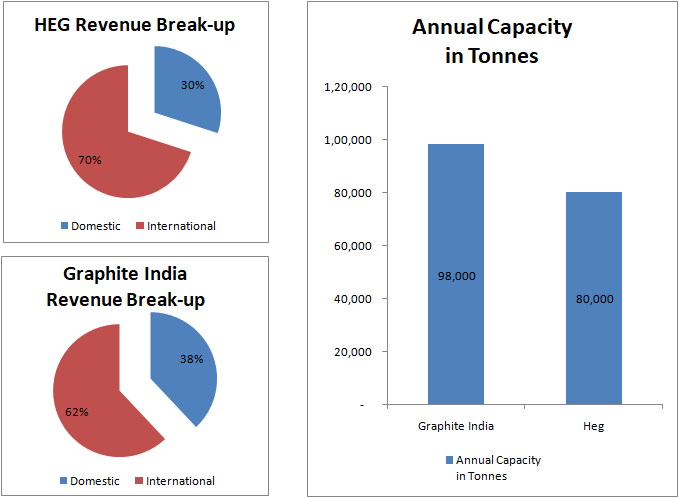

| 4 | GIL | 60 | 98 | 98 |

| 5 | Tokai | 100 | 100 | 95 |

| 6 | HEG | 60 | 80 | 80 |

| 7 | NCK / SEC | 60 | 60 | 60 |

| Total | 860 | 808 | 725 |

Source: Centrum Broking Research Report

As you can see after the consolidation of the industry, Production capacity decreased by 20% approximately.

Why and How things changed for Electrode Industry!

As we all know, major cities of China Beijing, Shenzhen, and Guangzhou were facing the wrath of rapid industrialisation growth in China in the form of Air Pollution. When this API (Air pollution Index) went to unsustainable level and smog had covered the city leading to low visibility and as airborne diseases were increasing, the Chinese government decided to wage a war against pollution, clamping down heavily on some environmentally polluting industries in China, which includes some of the highly polluting steel (As already mentioned, China produces 90% of steel with Blast furnace which is highly polluting) and also some of the very old graphite electrode plants. This resulted in some major closures of both very old environmentally unfriendly steel plants as well as graphite electrode plants.

On the steel front, lots of induction furnaces had been asked to shut down, resulting into starting up of many Hitherto electric arc furnaces, and seemingly some kind of shortage of steel in China has erupted. This had also resulted in a spurt in steel prices in China. The closures of induction furnaces had also increased the availability of steel scrap in addition to a reduction in the prices of steel scrap, which was obviously beneficial for electric arc furnaces, and consequently for the electrode industry. All these not only led to an increase in demand for electrodes in China but also led to a sharp drop in the export of electrodes in China to most of the Western world countries, including India, thus opening the doors for the Indian graphite industry. This obviously augured well for Indian companies.

China’s net steel exports were down by 15.5% in the first half of 2018 to 28.7 million tonnes. This allowed increased steel production and higher utilisation in the other EAF steel producing nations. The closure of inefficient induction furnaces and highly polluting blast furnaces in China were being replaced by environment-friendly electric arc furnaces (EAF) which were supported by an increased availability of scrap.

Around 56 new EAF furnaces are expected to come online in near term with an aggregate capacity of 60-70 million mt. The share of steel manufacturing capacity using EAF has already risen to 9 percent in 2017 from 6 percent earlier.

The Chinese government has set a target of achieving 20 percent steel production through the EAF route by 2020. Additionally, recent closure of 2,00,000 -3,00,000 tonnes of electrode capacity led to shortage of electrodes.

Such developments augur well for the industry and have led to an improved demand and supply balance in Electrode Industry favour, along with favourable electrode pricing scenario. These factors have resulted in increasing demand of graphite electrodes.

As discussed before, there are only seven players in this industry and many of their capacities had been shut down. So, Supply was limited and after this drastic development in Steel and Electrode Industry, the prices of electrodes shot up from $2500-3500 to $12000-15000, in matter of few quarters. Sometimes spot trading in electrode happened at $25000 leading to euphoric condition in this Industry.

Change of fate of Indian Electrode Manufacturers (HEG and Graphite India)

There is drastic improvement in all financial numbers and ratios, since development have happened in China.

Now after reading this blog what do you think are upside and downside for the graphite electrode industry?

Do you think the growth which has come in the past few quarters be able to sustain??

The Upside and Downside:

China is entering in the UHP grade Steel manufacturing zone and as mentioned earlier China doesn’t have the technology required to produce those UHP electrodes and so the demand for the graphite electrode industries is going to increased.

Another positive for graphite electrode Industries is 5 years of contracts are fixed which secures substantial amount of their production capacity so even if the graphite electrode prices go down they would be least impacted.

Another upside for the Indian graphite electrode industry is that they have paid off their long term debt considerably due to sudden positive cash flows. So, these companies are virtually debt-free, due to this their interest cost has also been reduced which will significantly impact the bottom line of the company.

To produce one tonne of steel, around 1.7-2 kg of electrode is required. As we mentioned earlier, supply of UHP Electrode is around 700000-750000 tonnes, so with this capacity only 350-400 Million tonnes of steel can be produced, which is 25% of total steel production. So, with China shifting towards EAF production method, demand is going to grow at steady pace but supply will be constant or will grow at subdued pace.

As there are only 7 players, to increase their capacity they can only do greenfield expansion (Adding new capacities) and to add new capacity 2-3 years are required.

Now even if the company adds new capacity to fulfill this new found growth they may not have the fuel required to support that growth, which is main raw material Petroleum needle coke.

Petroleum needle coke is 44-45% of total raw material cost, but with increase in demand of needle coke by Lithium ion batteries manufacturers, there is scarcity of supply.

Moreover, electrodes are the main component of steel manufacturing and steel being a commodity its demand is dependent on the economic cycles and demand supply of the industry, so steel’s demand is very variable and difficult to predict and electrode being the required raw material for it. Thus making the electrode industry also a cyclical industry. (depending on both steel demand and commodity price) thus graphite electrode industry, indirectly has no control over price of its goods nor on demand of its goods.

One more important point to consider is that the Indian companies exports around 8-9% of their electrodes to Iran and after the ban on Iran to not import any goods from any countries by USA because Iran is oppose by US for conducting Nuclear Tests. So, they have excess 8-9% supply of their for which they have to find a new buyer.

What is your bet on this industry? This has the ebb and flow of a cyclical industry but has been able to sustain margin and growth as a sector for a few quarters now and even if margin contractions does happen the effect would be less as present margins are already unrealistic (80% Ebitda margin). So, after PE contraction every pundit in the market thinks that earning contraction would proceed but after studying the nuances of this sector do you think earning contraction is a possibility??

And do you think it will follow the trend of common cyclical or will it emerge as something different altogether.

Sources: Annual Reports, Investor Presentations, Con-calls, Capitalmind’s Article, Finception’s Article, Centrum Broking Research Report.